Solar Power isn't just about profits.

Previously, we talked about how solar power is growing spectacularly. So the question arises: who is building all these solar farms, and why? Let's pop open Hyaline and have a look around to see what we can find out.

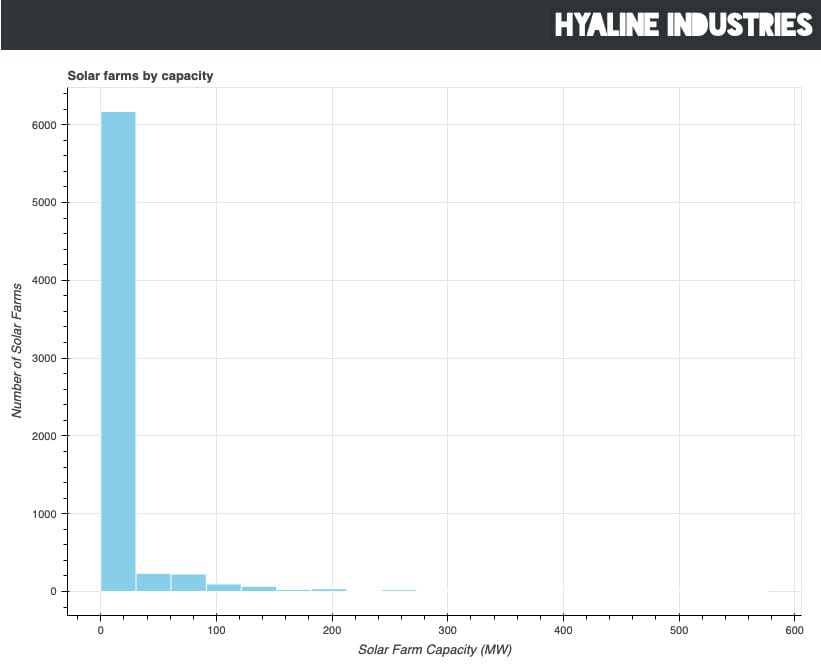

There are 6907 different utility-scale solar farms in the United States. But, they are not distributed the way other power systems are:

The overwhelming bulk of solar farms in the U.S. are small--this trend is so pronounced that you can barely even see the very few farms which have more than 500MW of capacity. In fact, the median solar farm size is just 2.5 MW, and 90% of all solar farms are smaller than 40MW. This is a distinct change from the coal power sector, where a relatively small number of very large generators made up the bulk of the power plants; here, small power is the game.

But while the farms themselves are small, are the owners similarly small? Maybe a large organization is building up tons and tons of tiny farms instead of a few large ones, after all.

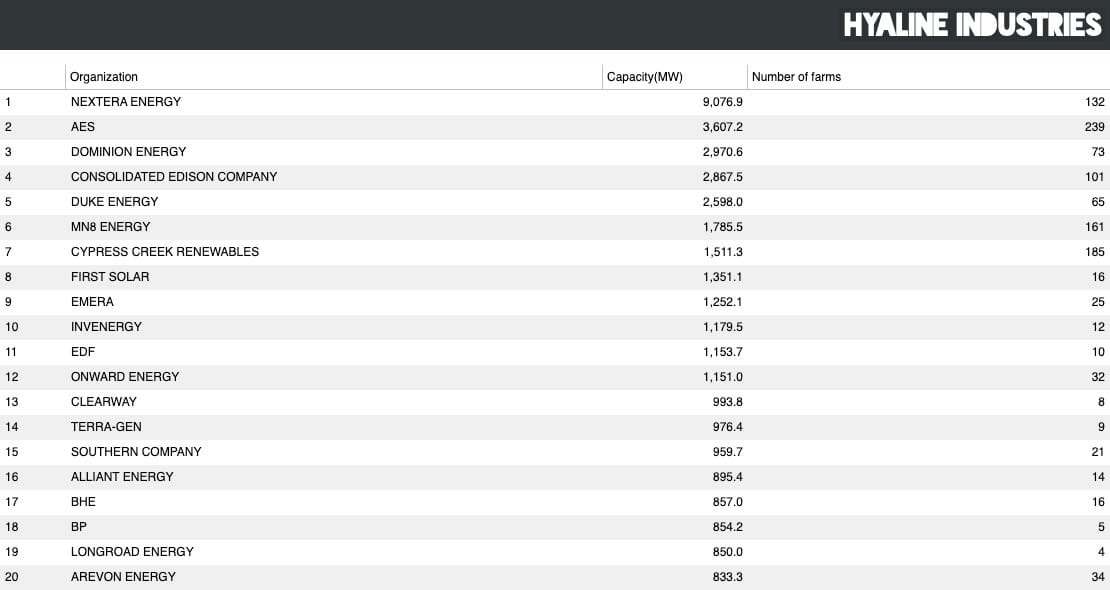

If we group up the owners of solar farms by their total owned capacity1, we see that there is some concentration happening:

Of the 20 largest solar asset owners by capacity, 5 have more than 100 separate solar farms under their management. But this top 20 only owns about 16% of the operating solar farms. And while there are some known power-sector companies on this list(NextEra, Duke, Dominion, etc.), there are also a number of newcomers: MN8 was spun off from Goldman Sachs, and Cypress Creek Renewables was founded in 2014. To make matters even muddier, of the 10 largest utility companies in the U.S, 4 show up on this list (NextEra, Dominion, Duke, Southern Company); the other 6 significantly lag behind. Xcel, the 6th largest utility by market capitalization, isn't in the top 100.

So what does this tell us? Well, we have three facts to synthesize: there are a lot of solar farms, most farms are small, and the major utility companies are only about 50% involved. If the major utilities aren't the ones putting up the capital, then who is?

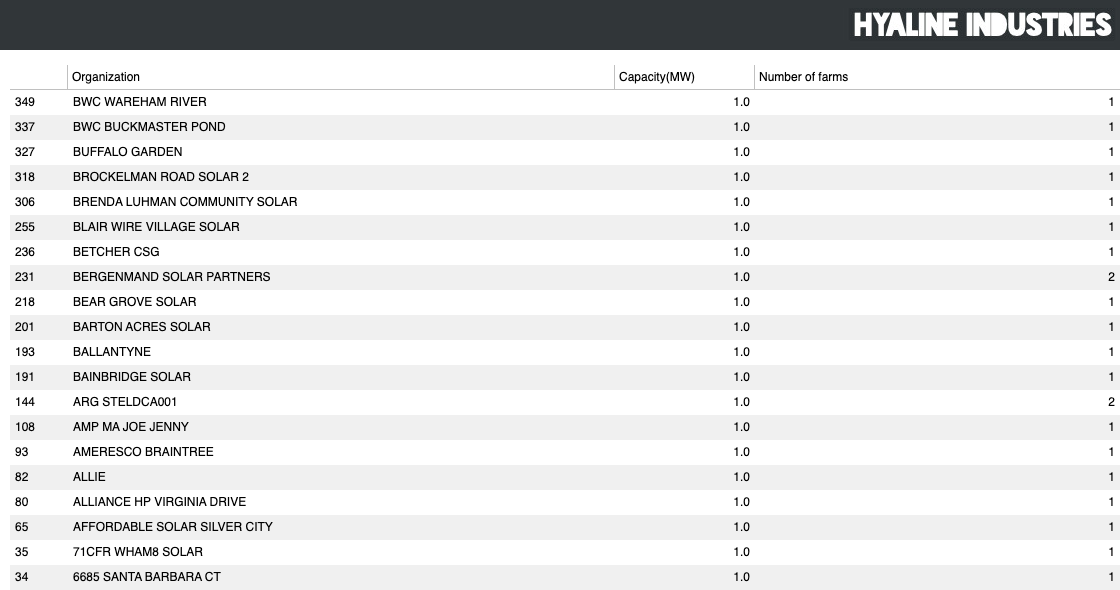

The small size of the farms gives the hint, but let's look at the bottom of the list for a second:

This list is only part of the rather large number of organizations which own 1 MW of solar capacity, but it's a good cross section of the list as a whole. The small end of solar ownership is full of small towns, community solar projects, factories and hospitals.

The thing is: if you are wanting to make money in wholesale electricity, you probably aren't building a 1MW solar farm. Sure, it will only cost you about $1.5 million to build, but it doesn't generate enough energy consistently enough to make you a significant profit. And, if you're a factory owner or a hospital administrator, you probably aren't all that interested in making money selling electricity anyway. What you are actually interested in is reducing your costs.

This then, is the kicker of the solar power industry. Small industry is engaging with solar power to reduce their electricity expenses, and small industry electric bills are large profits for power distributors. The explosive growth in solar power isn't coming from utility companies, it is coming at the expense of utility companies.

Like what you're reading? Be sure to sign up for our newsletter and get more updates as we build out hyaline! And if you have any questions, or anything you're wondering about, please feel free to let us know at questions@hyaline.tech